-

Posts

3,191 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Everything posted by 1776

-

That verse of scripture says it in black and white. It is the truth.

-

I-4 through Orlando is a major traffic cluster. Last year we did I-95 to I-4 to Lakeland…brutal. This year we went to Ocala off I-95 around Jacksonville and avoided Orlando altogether, going and coming back. The Cactus League would be a great trip one year. My wife wants to go there next year but she heard that there were Tarantulas in Arizona so that might not happen. 🫣

-

The Royals were playing the Astros that day. As I recall, either the infield or the out field was an artificial surface.

-

Haines City. Was there for a ST game in 1988 when the Royals were there.

-

Well, if they need someone to throw BP they found their guy.

-

He mixed in a wild pitch as a bonus.

-

The quiet talk is getting loud. As he considers walking away from a stadium deal in St. Petersburg, Fla., Tampa Bay Rays owner Stu Sternberg is being pressured to sell his team by commissioner Rob Manfred and some other owners, people briefed on the ownership-level conversations who were not authorized to speak publicly told The Athletic. https://www.nytimes.com/athletic/6189456/2025/03/09/commissioner-owners-pressure-rays-sale-mlb/

-

Skub Day

-

The MiLB players are union now, am I correct on this? If so, would they play if there was a lockout? Do minor leaguers have a vote in the agreements?

-

Yes. This is the biggest concern I have about a lockout. Additionally, I believe lockouts would include the minor leagues as well as they are now part of the contractual agreements between ownership and union.

-

It’ll be interesting to see how much ball is played in 2027. The word “lockout” is already in the conversation.

-

Good pics. You get a Jobe start out of the trip. Nice. Gotta’ believe Max will play some if rode the bus over.

-

Prior to the 2019 season, Urquidy was known as José Luis Hernández. Hernandez changed his name after parting ways with MS-13.

-

New York Yankees starter Gerrit Cole will undergo diagnostic testing on his right elbow, according to a league source.

-

https://www.mlb.com/news/farm-system-rankings-2025-preseason?t=mlb-pipeline-coverage Tigers on top followed by the Rays.

-

My impression of Dan’s timetable for Vierling’s return is about six weeks. Three weeks rest and three weeks getting back up to speed. That’s brutal.

-

-

The original publication of Al Stump’s book was in 1961, the year Cobb died. A reprint of Stump’s book was done in 1993. Charles C. Alexander, a history professor at Ohio University, also did a Cobb biography in 1984 titled, Ty Cobb. Alexander is guilty of repeating some of Stump’s unfounded tales in his book. Several years ago I read a Q&A that Charles Leershan did regarding previously published inaccuracies that he had uncovered in his research of Cobb’s life. Leershan personally questioned Alexander on several statements he made about Cobb in his book, Ty Cobb. When Leershan pressed Alexander for evidence on several of his statements in the book Alexander had made regarding Cobb’s character, Alexander conceded that he was only going by what had been written up to that point. I guess it should be no irony that the Introduction for the reprint of Stump’s, My Life in Baseball, in 1993 is written by Charles C. Alexander.

-

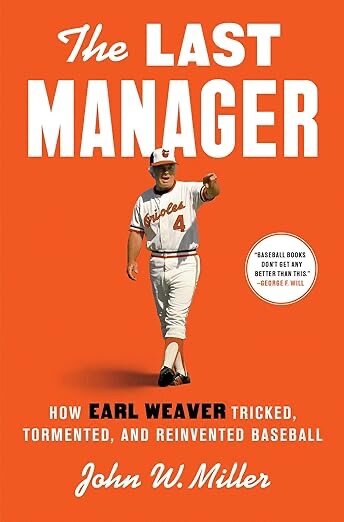

This book releases tomorrow. The pre-release reviews are very high on the book. I’ve never been very knowledgeable of Weaver’s history so I’m ordering this one to get up to speed. I really wish someone would write a book on Sparky comparable to what this author has attempted to do for Weaver.

-

2/27/25 1:05 Split Squad Gm1 Red Sox @ Tigers Gm2 Tigers @ Rays

1776 replied to Tigeraholic1's topic in Game Threads

…and he should have spent more time developing in the minors. Avila was trying to keep the wolves at bay so Tork’s premature promotion was an easy distraction from a flailing GM. -

We saw him start two games at first base. I’ll admit I had reservations about him moving to first but the several chances he had, he looked good.

-

Báez to DH today and this weekend and start at shortstop on Monday per Andrew Jay Hinch.

-

2/27/25 1:05 Split Squad Gm1 Red Sox @ Tigers Gm2 Tigers @ Rays

1776 replied to Tigeraholic1's topic in Game Threads

Matt Manning needs a solid start in a bad way. He wasn’t good at all the first time out. -

Not sure of what angle the cameras provided during the game but AJ and Fetter were sitting immediately outside the dugout with their chairs facing the field behind a framed net used for infield practices. They weren’t actually in the stands. We were in section 205 straight up from where they were watching the game. When the Tigers were in the field, Fetter would take a seat along side Hinch to watch the pitcher. When the Tigers were batting Fetter would give up his seat beside Hinch to an offensive coach. If I’m not mistaken, I believe it was George Lombard that sat by Hinch while the Tigers were batting (if you can call what they did today batting). This is how they did it last year as well when playing in Lakeland. Hinch & Company pretty much stay in the dugouts on road trips. Hinch is into it. He’s worth paying attention to during games, which I’ve fallen into a habit of doing. Regarding Scott Harris youthful looks, he does look very young in person. The brass will sit down in the lower section of seats immediately behind the plate. I honestly don’t think anybody even realizes who he is when he’s in the crowd. Gibby was on the road yesterday in Sarasota and managed to sit in the heat for about half the game before moving to someplace cooler. I’m surprised he traveled yesterday as there was no coverage of the game. This can’t be easy on him.

-

Skubs followup pitch clocked at 100 up…but not in.