Screwball

Members-

Posts

858 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Everything posted by Screwball

-

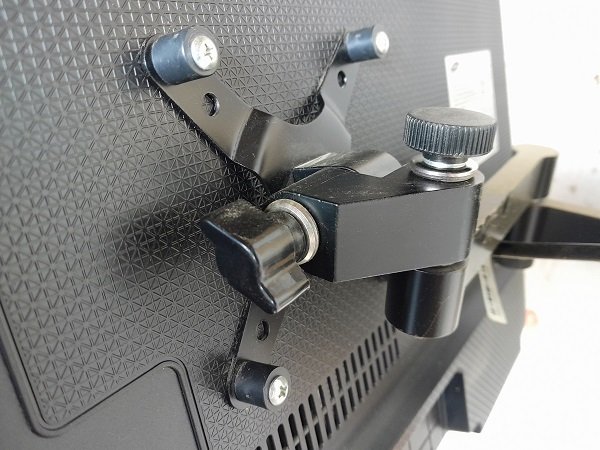

Let's talk TV mounts. I'm sure most here have a TV, and have mounted one to a wall. I ran into a TV deal so I bought a cheap one for the garage. Attached, but not heated, so I want to take the TV inside for the winter. I have another I take in and out every year, and it's a pain. It should be easy, but you always need a tool of some kind. I do, but why? I have the answer to that dilemma, kind of. One of my mounts is so easy to take off the TV, all you have to do is take out a thumbscrew and lift it off. When you put it on, just drop it on the spindle, screw in the thumbscrew, and done. No tools needed. Couldn't be easier, and I applaud the design. But I can't find it. I checked my history purchases, searched all the usual suspects in retail land, and come up empty. Here is a picture of how it mounts. Bueller? ON EDIT; There might be more TV mounts than flies

-

Ok, based on the above from the helpers; U+D=G in F vs. G. Giggle

-

I learned something new today. I don't think that should apply exclusively to crypto though. FUD - three letters. I'm more binary. Fear vs. greed.

-

What is FUD distribution?

-

I remember sitting in some corporate obedience training classes where they used Intel as an example on how to grow and control your own market - and they were right. Which is the kind of company you want to find and invest in. Not anymore, and not for a long time. I think it all changed with the Enron stuff. Jeff Skilling should be on the Mt. Rushmore of financial criminals in my lifetime. He gave us the blueprint of how the leverage machine runs today. Between Arthur Anderson accounting (some now legal that saved the world in 2008 (see FAS 157)) - and no rule of law - we end up with a rigged casino. Guess who loses.

-

It is the Fed's job to screw things up. We wouldn't be in the position we are in if it wasn't for the Fed to begin win. The market has crashed twice since I've been investing because of bubbles - and they still don't know what one looks like. But they are only part of our financial system that is a sick joke.

-

There is more issues than PC sales.

-

I wasn't talking about the investing end of things. I've been a part of too many companies where the beancounters determine/have control over too many day to day decisions made within the company. Many times look to the short term instead of the long term - hence the penny smart dollar stupid. They only see numbers on a balance sheet, not design, engineering, manufacturing, marketing, etc. Too many times the cheap quick way to do it eventually hurts the company in the long run. They might get a bunch of good quarters, but then it catches up with them, and the bottom drops out. And as beancounters, I don't only mean the accountants of the company. This holds true for the board and CEO's. They push the stupidity because they are loaded up with stock options - so cut cut cut - beat the street. It's not a good business model IMO. I used to go to an annual software thing for my company. Several thousand people were there. Bunches of them from HP. I talked to these guys every year. They said Carly Fiorina was running the company in the ground. She was awful, only cared about "now" and would not support and spend where they needed to for longer term growth. They hated her with a passion for what she was doing to the company. The rest is history. At least they got rid of her.

-

INTC (Intel) getting whacked to a tune of around %6 on troubling guidance based on what I read. Was down over 8 earlier today after their earnings release.

-

I'm sure most people here do somewhere in their portfolio. So their our crooks. 🙂 It is truly amazing what the large Wall Street banks get away with. Kinda, I guess, depending on how you look at it. I go back to the financial crises of 2008-2010 ish with the aftermath. The banksters, with their reckless leverage blew up our financial system, the stock market, and many peoples lives. And they get away with it because they really are "the smartest guys in the room." Along with owning everyone because of money they don't even have.

-

While I'm here, I didn't dig in too deep because I was short on time, but that FTX guy, or whoever he is, other than a giant crook, was banked by JPM & GS. Imagine that. Back when I was a pup, we would call them the mafia. We just legalized it. Ponzi schemes, money laundering, propping up evil regimes. Money to be made so it's all good. Pay a fine, admit no guilt, business as usual. It all starts with the banksters.

-

Another example of pump and dump bullshit when you have a giant bubble. I think, someone correct me if I'm wrong - but BBBY was one of those momentum junkies the Robin Hood traders were all over a year of so ago. Many are now broke. Dumb fucks The market is a whore

-

To the bold - I couldn't agree more - and it doesn't matter the industry. I could write a book. Many have - nobody reads them - or listens to what they say even if they did. And it all starts with Wall Street - the swine fucking banksters - who demand the quarterly earnings report beats expectations. Penny smart - dollar stupid.

-

The GDP number wasn't as good as the headline numbers say it is, neither is jobless claims, but only the lazy/hacks report it that way. BBBY (Bed, Bath & Beyond) is about to go bankrupt. They got a default notice from the criminal bank JP Morgan. Stock was halted a bit ago, not sure now.

-

Hawley introduces Pelosi Act banning lawmakers from trading stocks - The Hill Too funny, but probably won't go anywhere.

-

I didn't know the Fittipaldi kid was doing that. I'm a big fan of Emerson, and I always thought he had a name that screamed race car driver. Emerson and Little Al at Indy was a classics of classics, whatever year that was.

-

.03 vs. .0945. Thanks, I didn't look up the number for SPY. They are ETFs, which are now in the thousands, but they are not all the same, and some down right dangerous. For example, leveraged ETFs, which most people should stay away from if you like to keep your money. I see these "expense ratios" the same as fees, or decay. Brokers might charge a trade fee, and some ETFs have higher decay than others vs the index it tracks. For Example USO and crude oil, or SPY and the S&P 500. At the end of the day, which ETF you chose depends on what you are trying to do - long term, short term, swing trade, day trade. There will always be some type of fee's or decay involved. Example; never use a leveraged ETF for a long term trade - the decay will eat you up. EFTs give you built in diversification, but you can always buy the underlying stocks instead and eliminate the expense ratios, especially if your broker doesn't charge trading fees. I like commodities but I have to use ETFs to do so - and they have noticeable decay - but doing your homework and getting the timing right will far outweigh the loses to to other circumstances. I never heard it called expense ratio, but I never really paid much attention to it. I'm too old to hold stuff for lengthy periods of time, which is why I'm doing short term bonds right now. With anything, it's all about the timing.

-

A couple of questions; Are you saying IVV is a buy right now, we should have already been in it, and if so, why? I haven't really followed the expense ratio thing too much, where does .03% compare to other ETF's. I always called it "decay" and some were worse than others as far as how they tracked the underlying. IVV looks to follow the S&P fairly well, but I don't know enough about it to know if they advertise tracking that index. Their top holdings are around 15 percent large Silly Con valley corps, not that I'm saying that's a bad thing - that's just how they chose to set up the fund. 2 year monthly comparison between IVV and the S&P - IVV in yellow

-

RE: Earnings calls If you have never listened to one of them, you should. Once you get past the boring numbers at the beginning and the questions start, they are very informative, and sometimes quite entertaining. Depending on the size of the company, there will be X amount of Wall Street analysis on the call - asking questions. They are public and you can listen to the WS guys make our companies big wigs look like complete idiots. They knew more about the company (industry/sector) than the people putting on the call - the big swinging dicks who we work for. Which is why they work on WS to begin with. And make a lot more money.

-

Thumbs up to Queen's Gambit.

-

I have no idea what this Elko stuff is all about, and I don't care. To the first part - people need to get into people. We really need to find a way to get along. We might even find out we have much more in common than hating each other.

-

For the record; I love Pink Floyd, Jim Morrison, and the Doors. Might be an age thing. Or songs connected to memories.

-

To the above; ewsieg is spot on. I don't know how mtutiger can come to that conclusion after reading the board since born here or the old site. Many have spent countless posts making fun of the dumb hillbilly hicks from places like Cornhole, where I come from. We just giggle - just so you know. I go to a shithole town bar where the guy across from me is wearing a "Let's go Brandon" hat, sitting beside his black girlfriend - who is sitting beside a pink haired gay girl who is sitting beside a couple of prominent local business owners - sitting beside the owner of the bar. Going the other way from the hat guy, there is a big black guy who works in a local factory and has a DJ service at night, then a couple gay guys in their late 60s who always bring in some kind of food treat, then a few retired guys, a couple of Latino's who work construction, students from around the world that go to our two local colleges, and some who just got off at the local factory that live paycheck to paycheck. A truly melting pot of Americana. We all get along and have a ball. How the fuck does that happen? This world has went completely insane. Don't be one of them.

-

Here is how I make money in the Lottery. I live in Ohio and have the Ohio Lottery app installed on our phones. A local watering hole I frequent has a couple lottery machines. People play a lot of Keno and/or progressive jackpot games. They can check their tickets for winners by scanning the code at the machine (before they buy more because they lost). They throw the non-winning tickets in the trash can beside the machine. I go in around 4pm. The machines are on the way to the bathroom so as I walk by, I grab a handful (or more) of tickets out of the trash, put them in my pocket, then proceed to the bathroom where I wash my hands. Later, when I get home, I scan the ticket into the Ohio Lottery app. They tell me they are losers but are worth 5 points (for Keno - some are more depending on the game). You can scan up to 1200 points each month, so I use two phones. Once I get to 10,000 I cash them in for rewards. I get a $100 dollar gas card, which for each phone gets me 2 $100 gas cards, which takes about 8 months, and doesn't cost anything. I've even found winners that someone threw away, so there can be a bonus. On the downside, I was scanning tickets at the bar one day and some guy beside me asked how I was doing. I explained I was just scanning the codes for reward points. His wife got pissed and said - you took "someone" else's ticket out of the trash to scan their points? Yep. That's pathetic she yelled at me. I just laughed. Best I can tell, if they threw them away, they didn't want them, so fair game.