Screwball

Members-

Posts

858 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Everything posted by Screwball

-

Just for fun; October: The Month of Market Crashes? - Investopedia

-

This was really strange. I didn't do anything any different that before. I take the screen shots and save to a file (.jpg). Then I open them and resize so they are 600 pixels wide, which makes them smaller than the original screen shot. When making a long post I usually save it to a word file in case this screws up I won't lose anything. I wondered if copy & paste from word might be the issue, so I copied from word to notepad (to remove any formatting that might be coming along). Nothing helped. I would push the post button, nothing happened. Then when I got out, I couldn't get back in. It would eventually time out. That's why I thought the board had an issue. Then I got the two images to post, but when I tried to edit, and add text, it said it took too long and wouldn't let me. Really weird.

-

Today's update after fussing with that above for an hour. Oil took a turn over night to the downside, which took this with it. By the time the market opened, it was down quite a bit so I pulled the ripcord as soon as I could, which was about 9:33. Sold at $66.00 just to preserve some profit. It looked like it was a good idea as it plunged to the downside right after, only to recover, and actually get back above the $66.25 sell level. Imagine that! But it is now drifting downward again. But it doesn't matter since it was sold. At the end of the day, we made $226.50 for a few days work. Nothing to get excited about, but since it was an impulse type trade to scalp a few bucks, I would say it was worth it.

-

This should be with the images above, but I can't post both at the same time (maybe not this at all, not sure). ****** Trade update after close. We lost some money today. I was going to set a stop and sell at $66.25 and get out of the trade to make around $250 bucks for a couple of days work. The hurricane stuff looks to be over (as far as this trade - so pull the ripcord and taking the money makes sense. Impulse trade anyway). But given the news and rumors (OPEC) maybe no need to jump ship just yet (pun intended). Today's print; See chart one above Notice how that candle hits the lines at the top and bottom. It is red because it closed lower than it opened. Happens all the time, but what looks like a very uneventful day, is interesting when you look at the intraday chart. See chart 2 above The gap got filled around 10 am (also filled overnight but that doesn't count). Could have sold early today and made about $450 - and there is nothing wrong with that. But let's let it go and see what happens since we are playing with house money. At 2:23 pm the price hit $66.25. Since that was the bottom of the gap, a perfect sell point. But it bounced right off that level to the penny. That helps validate the sell point. It traded almost all day in the gap, so we will wait to see what happens. For now we stay long. Sell at $66.25. It still might be a short trade. Which was what we expected from the get go. But it might not.

-

Is anyone else having trouble posting here? This thread or the board in general? I have had trouble accessing and can't post. Not sure this will work. Yes, cleared cookies.

-

We are back in the green, despite what the broader market is doing. The gap is now closed. I would like to see this close above that level ($67.49) so it becomes the resistance, and potential sell stop. It had moved lower this morning along with the broader market, and less chances of disruption from the storm, but might have reversed on this news; OPEC+ Discusses Cutting Oil Output at Next Week’s Meeting - Bloomberg **** FOREX chart porn.

-

The only thing we need to understand is the financial wizards of the world are trying to put toothpaste back in the tube.

-

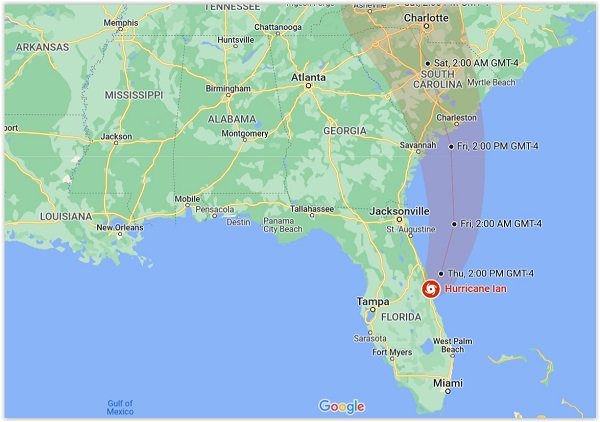

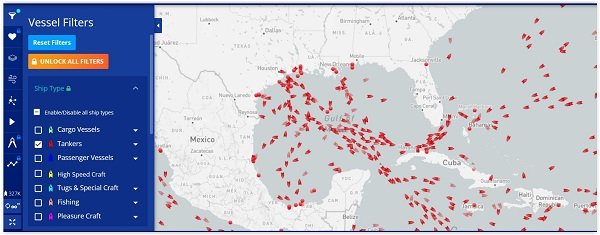

Trade update. Our trade may be wearing thin. Down a little today, and as we know, the trend was down anyway. It got to $67.45 which is .04 from filling that gap. Looking at the hurricane tracking and the shipping traffic, the disruption may be about over, if not over. Those are tankers. Only a few in the path it appears. I will watch the action and won't hesitate to take a profit, but will let it run and see what happens - for now.

-

The currency stuff isn't my bag. But I know the potential consequences that come with it. I go back to the floor trader I quoted above. Depending on what to believe, the machine seems to be spitting oil and making funny noises. Who holds who's debt, and who's will be fucked? Every currency against the dollar is getting smoked. I don't know if this has ever happened. He's spot on with these kind of moves spells trouble - and this is maybe an example. Currency markets are huge leverage, because they don't move much, so the only way to make money is with a bunch of it (money). More money, more pain. That will go on til it don't.

-

Now I to have to give up chart porn.

-

Trade update after today's close. Still holding, making some money. Closed at $67.13, so we are up $396 since purchased.

-

Given the pipelines that were blown up where right in NATO's "lake" I'm not sure this is anything but propaganda.

-

They capitulated, and investors think our Fed will too, which is what's driving the market today.

-

I think our world lunatics are working on that.

-

Now that I've looked at this, it turns out to be a really neat setup. Depending on which way oil goes (and our derivative), and it goes up, there is a gap to fill. Over time "almost" all gaps will fill. See chart porn below; If this gap closes, which it will at some point IMO, the price will be $67.49. You could pull the ripcord right there and make about 450 bucks and be happy as a pig in the mud. Or, you get stopped out and take the 200 dollar beating.

-

Trade update. The trade is still in play, but I adjusted it a bit. I screwed up when I entered the sell order and it cancelled. Then, looking at the chart (another screw up because I missed this) I see an obvious support level just to the left so I entered another sell order at $63.15. This time "GTC" or "good till cancelled." But we now lose $201.21 if it trips. This is really a stupid trade, but fun to see what might happen. I can see a bunch of those Robinhood traders doing something like this, but they have been fleeced and many long gone. Along with a bunch more to come. This should be a short term trade to make money on potential disruption of energy logistics. Or maybe not... If the broader market is going the other direction, you are going against the trend. The "trend is your friend" as they say. I'm also watching (the price of crude obviously since this is a derivative of crude) RBOB gasoline and natty gas. They are trending with crude, as one would expect, but natty is up a couple percent tonight.

-

At 9:33 today I bought (not really - paper money account) 150 shares of USO at $64.49 for a total of $9673.50. Of course since then the market has turned over and this ETF is now trading at $64.15 and we are underwater. For a trade like this I'm only willing to lose a couple hundred bucks, or around 2 percent, so I set a sell stop at $63.20, which would lose us $193.47. The S&P peaked at 9:41 am at 3717, but has dropped to 3646 as of 12:10. A reversal of 71 points. We are liable to get stopped out of this trade.

-

There is an old saying in the market; don't try to catch a falling knife. That would be today for the oil trade. Everything down. No good entry. Down %2.5 as I type this. GBP/USD recovered about half of what it lost last night. World financial wizards are mostly silent.

-

To my point above about uncertainty. This guy is an old floor trader and has been in the business for a long time.

-

That isn't the only cause, and certainly not the entire cause. This is a boiling frog, and has been. CME Halts British Pound Futures After Flash Crash to New Record Low vs the Dollar **** The S&P futures are down about 22 as I type this. Crude is about $78 and has drifted down all night. I will wait and see where this goes as we get closer to the open, and probably wait and see what oil does (and USO) before pulling the trigger on the trade. IF the FOREX stuff rattles the markets it could drag crude along with it. I have to go so I will have to see what the action looks like when I get back home around 2. Since this is a "impulse" trade, I can't just set a buy order or limit order with a stop, you would need to watch what happens and pull the trigger when and if it presents itself.

-

Almost bedtime as I have a class tomorrow, so I'm looking at the futures before I go nappy. Crude is up slightly @ $78.90ish. S&P futures down 17. See what happens while we sleep, but there are some potential problems. From the FOREX world the GBP/USD had a flash crash. Twitter said the CME halted futures. The pair is down around 3% which is huge in the FOREX world. Read; the weather may not matter. We'll see what it looks like in the morning.

-

Let's have a little fun here. I admit up front I haven't done my homework on the potential disruption due to the hurricane - but is there a trade here (short term)? For reference, the latest crude print. Note the $78.04 low from Friday. Come Monday we are going to go long oil because we think it might jump given the hurricane. The easiest way for the retail trader to do so is using an ETF. In this case - USO. Closed Friday at $65.32 with a low of $64.65. So the plan in this paper trade is to buy some USO come Monday morning on open - depending on the current price of course. We're going to spend $10,000. The success of this trade will depend on the weather at the gulf coast. If it is bad, probably a good trade. If not, you can get smoked. The trend for crude is down (see chart). We are only looking for a few percent. Maybe 4-5 percent over a couple of weeks. I can see people making this trade so I'm curious how it might shake out.