Screwball

Members-

Posts

858 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Blogs

Store

Articles

Everything posted by Screwball

-

So give us some links proving this is feasible, and even better, a solution to our energy issues. Better yet, since this is an investing thread, how about some ticker symbols? It takes about 5 tons lithium carbonate to yield one ton of lithium. How much will it cost to fetch, mine, and transport 5 tons of that from some fucking asteroid back to earth, then process that into batteries? Pardon me if I think you have your head planted so far up your ass you couldn't blow your nose. When you are done with that little assignment, you can kindly fuck off.

-

Also... should we start capturing and mining asteroids? We have the technology. Just a thought What's the EROEI on that? Maybe we can have battery powered rockets and excavators. This is why there needs to be adult conversions, not pie in the sky bullshit.

-

The US has 3.6% of the worlds lithium reserves. Not much help.

-

Not intending on starting a huge pissing match, knowing the audience here, but I will say this; I am all for alternative energy in whatever forms it can be used/created. But, we really need an adult conversation on how to transition in that direction. I have had many conversations with my mechanic buddies, fellow civil, electrical, and mechanical engineers, and we end up with more questions than answers. We (humanity) don't have one (a transition plan), and best I can tell, we aren't going to. There are so many questions, problems, hurdles. It all starts with EROEI - energy returned on energy invested. The conversation HAS to start with that. Anything else is bullshit. Subsidizing energy is a fools gold, and doesn't solve the problem. I expect an entire industry of bullshit, and another industry of gaslighting from the pukes trying to score points one way or another, while not having any real workable plan. This country cannot tackle this issue as it stands - we are completely dishonest, uninformed, and inept. I'm old and will be dead soon. I'm glad. You young people are going to have to live with, deal with, and try to fix these issues. Good fucking luck! Right now, the pukes pulling the strings couldn't pour piss out of a boot if the directions were on the bottom, which should be obvious to anyone who doesn't have their head up their ass.

-

Becoming an Enlisted Soldier or Army Officer Knock yourself out

-

And while I'm here, on EVs Hundreds of new mines required to meet 2030 battery metals demand — IEA report So what and how many countries are we gong to invade or fuck with to pull that off?

-

Or you can go to your county auditors site and the size of the house is public information complete with floor plan.

-

You don't need a fucking spectrometer. You have a round device that runs around your home and bangs into things while doing a piss poor job of collecting dirt. The rest is simple math, the Cartesian Coordinate system, and a comma. But now we are in tin foil hat territory, so fuck that. The almost 20 percent jump on the news would be good though.

-

Looks like a loser as a company, and their chart has been ugly since November of last year. Appears there might have been some chatter about this takeover as the price jumped in mid July this year. Someone always knows. Not done yet, I get it. Other than that, it's all about what you think of AMZN and how big of tin foil hat you wear. That's a conversation for the cesspool of idiocy that dominates our political discourse today. I would be more concerned about how our monetary wizards give us the soft landing they promise they can deliver as they continue to raise interest rates.

-

Consumer Credit (from earlier this month) from the Fed Reserve; May 2022 That was released July 8th. Warning; most here won't like that guy, but the numbers are what they are. I have also read, or maybe it was from a Telecom conference call that more people than ever are behind on their payments. My point? Seeing data like this doesn't make the case for people full of money. And no, the stock market is NOT a reflection on the economy. It's the same old same old; who got more wealthy and who get less wealthy during the pandemic (or any other time as well)? Same as always, the money goes to the top. Stimulus is just another word for "trickle down." The money goes to the top first and it doesn't make its way to the people who need it most. The same people who suffer the most from inflation. You will have nothing and like it serf, so STFU.

-

Today's data; Jobless Claims GDP Some interesting numbers in the charts from the GDP print.

-

I can't wait until they bail out the bankers again.

-

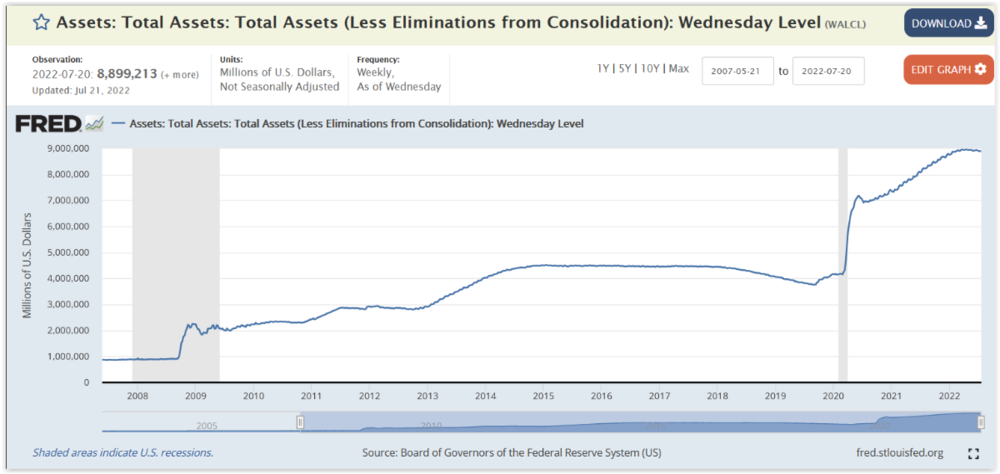

2008 - Imagine that!!!!!! When ZIRP (zero interest rate policy) or what one might call cheap money became a fad, and somehow sound monetary policy.

-

I'll use this Tweet as a visual. That is a chart of the S&P from 1992 thru today. The two bumps you notice going left to right is the dot-com bust of 2000ish, and the next is when the swine fucking banksters blew up the world in 2008/09. Then look what happens. Does that look normal? We are in the everything bubble, which has been brewing since March 9th, 2009 (I think), at least as the stock market goes. The financial hucksters in can spin it any way they want, that's easy. Interest rate hikes are not going to fix anything, especially in the short term, and they can shoot the blame cannons anywhere they want for how we got here, but the problems are many, and have been festering for a long long time. We have a perfect storm of circumstances while sitting on a 8.5 trillion dollar Fed balance sheet they are trying to unwind. These rate hikes will kill housing/real estate, which is already showing up in the numbers. Same with cars, or any kind of loan . The price of borrowed money - imagine that. If shit gets bad, they will quit hiking, and then lower them again to spur growth and spending - same as it's always been. But the bubble is bigger this time. If you read to any extent the monetary wizards talk about a "soft landing" or whatever the fuck. Fedspeak BS - because you can't fix inflationary pressures without pain (for somebody). But if they decide to lower rates again, all they can do is print more money to monetize more debt - which pushes the rates back down. Groundhog day. This time it's different. The world is moving in a different direction. Trade, alliances, forms of barter, and monetarily. Trade is the most important. We have spent the last 25 plus years transitioning to global manufacturing, and it's about to bite us in the ass. The Fed can't control that, and they probably won't control the part they can very well either, because they are inept, and should be given no credibility by anyone. There is no reset button and Mario gets to start at the beginning and everything is rainbows and ribbons. We will see pain. The question is where and by whom?

-

I think most expect 75 bps, and everything is green. I'm watching this one (crude oil) as something has to break one way or another pretty soon.

-

What is the weight to hp ratio of a F1 car?

-

Dude, please go find the nearest mental hospital and check yourself in.

-

I wondered this myself.

-

They were not suppose to report earnings until August 16th, so this is an "early" warning. Not saying they are a buy or sell. But down 10% after hours is a sign of bigger things IMO. WMT being the bellwether stock it is. It would be an interesting conference call. If anyone has never listened to a conference call, they should. They can be wild. It starts with the number guys spewing verbal sleeping pills, then on to corporate bullshit they planned to fool the Wall Street analysts. Once the WS guys start asking the questions, they are exposed for what they are. The WS guys know more about their company than they do - that's why they work on WS. One of the things that helped bring down Enron was Jeff Skilling calling some analyst an asshole. Too funny. I remember listening to my companies conference one time and the WS guy says "when the hell are you going to make any money." Crickets. You can also go to what they call EDGAR, which is via the SEC. Here is a link to today's WMT filing. Walmart Inc. This is the kind of fun stuff we used to do, but don't need to anymore. When all they do is print money it doesn't matter. <picture of easy button> 🙂

-

If central banks had a fucking clue they would never have blown the bubbles to begin with. They are shysters only to make the rich richer, which is why they printed trillions of dollars to begin with.