Screwball

Members-

Posts

866 -

Joined

-

Last visited

Everything posted by Screwball

-

I think most expect 75 bps, and everything is green. I'm watching this one (crude oil) as something has to break one way or another pretty soon.

-

What is the weight to hp ratio of a F1 car?

-

Dude, please go find the nearest mental hospital and check yourself in.

-

I wondered this myself.

-

They were not suppose to report earnings until August 16th, so this is an "early" warning. Not saying they are a buy or sell. But down 10% after hours is a sign of bigger things IMO. WMT being the bellwether stock it is. It would be an interesting conference call. If anyone has never listened to a conference call, they should. They can be wild. It starts with the number guys spewing verbal sleeping pills, then on to corporate bullshit they planned to fool the Wall Street analysts. Once the WS guys start asking the questions, they are exposed for what they are. The WS guys know more about their company than they do - that's why they work on WS. One of the things that helped bring down Enron was Jeff Skilling calling some analyst an asshole. Too funny. I remember listening to my companies conference one time and the WS guy says "when the hell are you going to make any money." Crickets. You can also go to what they call EDGAR, which is via the SEC. Here is a link to today's WMT filing. Walmart Inc. This is the kind of fun stuff we used to do, but don't need to anymore. When all they do is print money it doesn't matter. <picture of easy button> 🙂

-

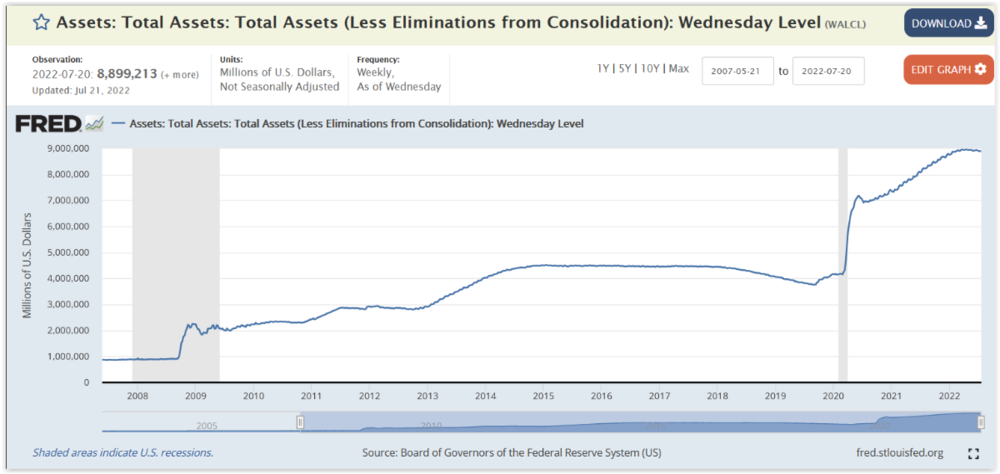

If central banks had a fucking clue they would never have blown the bubbles to begin with. They are shysters only to make the rich richer, which is why they printed trillions of dollars to begin with.

-

Economic calendar - FRB of New York That link is to July economic calendar. If you don't like that one you can find others all over the web. These releases are embargoed until a certain time on certain days. They will help understand what the economy is doing. But beware; read the actual reports, don't rely on the press to give you the straight scoop. They usually report the "headline" numbers which many times doesn't reflect the real picture. As far as inflation, we are seeing commodity prices go down, but those are only part of the CPI basket. If you search for CPI basket weightings, you can see a better picture of what makes up the final numbers. Gas and food prices are only part of it.

-

I don't know what's going on over there, and I don't know why, or how COVID has to do with banks, or not, or what to believe about anything. But it looks to me like some sort of a bank run. That's never good.

-

One last bash of Cramer. The tape will read DOW -215ish. In reality, it gapped up, shot to 31,644, then took a shit for the rest of the day and closed at 31,072. That would be a -572 pt swing by the Bambino known as Jim Cramer, if my math is correct, and I've had a few beers, so it may not. Not that this great American huckster had anything to do with today, because he didn't, for the record. He got to ring the bell, and I can no longer get a tour of the cavernous building known as the NYSE. They quit that after 9/11. To this day that breaks my heart - the only reason I ever wanted to go to NY. But it fits. He's one of the most well known financial guys, TV, books (I read one of them) - and has been full of shit for as long as he's been spewing BS and pushing his buttons - yet they put him in front of a camera every trading day. Apparently, being a stooge still makes you a pretty good living (of course, that's how it's suppose to work dumbass). Our poster boy for what is wrong with the financial media. Here, have some fun. Mad Money Soundboard

-

Related to the Jim Cramer stuff, I saw this tonight. I wondered if that was true, so I spun up the charts (it's Sunday night anyway) and went back and looked it up. Sure as shit, kinda, the Whale is right. But according to the charts (history), the Dow (looking at that) opened at 17,989, and closed at 17,662 (that day). My math says that's 327, not 332.7, but no biggy. The fact that people actually watch a huckster like him tell us too many people have their head up their ass. And for the record, I don't want to insinuate he was the reason for that market drop that day. We don't know. Still funny, screw him.

-

For sure, and Bubblevision (CNBC) leads in fuckwads. I don't remember who it is, but someone on Twitter is always Tweeting about Cramers's bad calls, and even keeps track of how much you would make if you did the opposite of what Cramer recommends. Next time I see it I will post. TBF, he is not always wrong, but kind of like a stopped clock. I've often wondered how many people actually look to business TV for investing advise. I always had it on, but only with the sound off. I watched for the breaking news and the occasional guest I wanted to listen to. I honestly can't think of one person, as far as anchors that didn't drive me up a wall with their cheerleading BS. Dennis Kneale was another giant POS spewing garbage all the time. I remember getting into a Twitter fight with him, which was hilarious. Him and Macke (who I kinda liked on Fast Money because he was funny) had a few epic run-ins, but I don't think either one is on the network now. Macke is funny and I still follow him on Twitter (as well as Karen Finerman (also on Fast Money)), but that's the only two. Mark Haines was one of the better ones. He did the morning show and on 9/11 was fantastic as all that went down. He died in 2011. Andrew Sorkin may have replaced him, but I'm not sure, but he's one of those people I would just like to smack upside the head just for being a complete and utter dick and deserves to be slapped upside the head. Dylan Ratigan could be good at times. He was the host of Fast Money at one time, but according to Wiki, he left as host of Fast Money in 2009, provoked by outrage over the government's handling of the 2008 financial crisis. In 2011 they he came back as a guest and this happened. An epic rant that probably cemented his absence. I still think he's kind of a hustler, but better than most they parade across that shit show.

-

I can't believe that fuckwad is still in front of a TV camera

-

I'm just asking questions. I have security cameras, 4 to exact. I cover most of my property and also see others. Mine are all wireless, but they are hooked into my home network. My home network is secure. If a camera triggers, a video is created, and stored internally to a SD card. I can access that through my computer, or phone, at any time. All safe, all internal to my network. I have an option to copy/store these videos to a cloud, which I assume is from the company that sells this stuff. I'm not interested. A picture or a video ends up as a file of some sort. You can move them. How it gets from the the SD card on the camera to any other place outside of your home network requires the date to go through the internet. A cloud is "space" in some form that stores data. It doesn't go from point A to point B without going through the internet. That's TCP/IP 101. TL;DR; If you are using a cloud of some sort, your data is on the internet.

-

How does the data get from the camera to the server in a data center somewhere?

-

What do you think the "cloud" is?

-

CPI; 9.1% (yesterday - lagging indicator) PPI; 11.3% (today - leading indicator) says "hold my beer"

-

Central Bank Digital Currency: Stability and Information Fuck you!

-

The only reason the media is fixated on GDP is because that's what narrative they want to push. It's easy to massage into what they want to propagandize using GDP numbers instead of more rigid metrics. This hack is just putting lipstick on a pig. *** Crude oil getting hammered today, down over %6. Small Business Expectations for Future Conditions Hits All-Time Low - June report Related and interesting; Kaiser Aluminum Declares Force Majeure at its Warrick Rolling Mill Due to Limited Availability of Magnesium Can shortage? Oh goody. Shit ain't good, go long lipstick (and bullshit).

-

GDP, a blast from the past. GDP was argued by pages in the old boards investment page. Was it in fact a good indicator of our economy, or not, or whatever? *** Speaking of which, that brings back memories. Del started the "Investment" thread on the old board. I remember some of the people. Rhino, Ballmich, Greenwit, a guy named Dan I think, and others I can't remember because I'm old and stupid. Those guys were badasses. *** The guy who wrote this article is a clueless fuck. Why is he trying to define a recession? It doesn't matter what you call it (or how you define it (example; 2 negative GDP prints)) - what matters are the numbers we see going forward - and what happens to the American consuming public. This is a wild time. There are jobs out there, and the labor numbers are not fugly, when you just look at the stats - so I will give him that. But too many jobs (or 2) aren't getting it done. People are struggling. I don't see any "wage earner's outlook" looking too good. Sure, some will make more, won't matter, costs eat it up. They even fuck us old people. We get a few percent SS raise, but our supplemental goes up X3. Thanks. All we need to watch is how we treat our veterans, our elderly, and our homeless. Besides, why invest in people when you can print gobs of money and make the right people rich? *** FTR; I spent 5 hours Friday and today dealing with my bank. All because of a purchase I made (have done several times before with no issues) that, this time, threw up a flag. Benny Hill would be proud And I'm a bit pissy

-

I looked for a mainstream source, but the rumors have been out since the Twitter/Musk deal blew up. This is ABC. Twitter says it will sue Elon Musk to complete the $44B merger he just rejected and is "confident" it will prevail I guess we'll see when and if the paperwork is filed, but go long popcorn if it does.

-

Released today from the Fed; Consumer Credit - G.19 Also contains a chart on other credit stuff.